Cineville: Rethinking cinema subscriptions

Photo credit: Iris Duvekot for Cineville

As independent cinemas look for ways to bring audiences back more regularly, attract younger generations, and encourage diversity in programming, subscription models are emerging as a strategic tool to address all these challenges at once.

By positioning themselves as part of a shared cultural offering, arthouse cinemas can counter the dominance of multiplexes and even streaming services with something uniquely of their own: a sense of belonging, spontaneity, and community. And this is where subscription schemes have the potential to turn this idea into practice, making independent cinema feel more accessible, more unified, and an integral part of daily life.

Finding the right model

In the late 1990s, French cinema chain UGC was the first to introduce such a model with UGC Illimité. They inspired many other chains to develop their version of the card, and we continue to see major players today - like AMC in the US or Nordisk Cinema in Scandinavia - launching unlimited schemes.

But these initiatives have generally remained the domain of multiplex chains, with independent cinemas struggling to develop a suitable model. The UGC card in France is actually also usable in several French independent venues, but there is no equivalent outside of France.

While often compared to unlimited models, discount cards for 5 or 10 visits don’t really serve the same goal or carry the same potential. A very small number of independents have developed their own unlimited cards, but they remain the exception.

Germany has been a fascinating case study in the incredible appetite for subscription models in Europe. Back in 2009, the Yorck Kinogruppe independent network launched its unlimited card, making them one of the first to do so in Europe. Much more recently, in November 2024, the Cinfinity card launched with the support of the German national film fund FFA. This card offers unlimited access to around 80 independent locations across the country. A few weeks earlier, local chain UCI had announced a major refresh of its own unlimited cards, adding new perks to the original offering. And in August 2024, Cineville Germany was launched, bringing the unlimited card from the Netherlands to its fourth market, alongside Belgium and Austria.

This is where Cineville stands out: it is the only example of a subscription model that is specific to arthouse and independent cinemas, and that has successfully expanded across multiple European territories.

This article takes a closer look at Cineville’s journey, the principles behind its success, and what subscription can mean for the future of independent cinemas. Full disclosure: I am currently working as Project Manager for Cineville as part of an EU grant supporting the company’s international expansion and the development of new digital tools.

From an idea to a national trend

Cineville launched in Amsterdam in 2009 as a local initiative aimed at making arthouse cinemas in the city more accessible, especially for younger audiences. The concept was born a year earlier, when four students found themselves in a nearly empty screening at the Kriterion, a student-run cinema in the city. They wanted to find a way to make young people more excited about cinema, beyond the blockbusters shown in multiplexes.

Their answer became Cineville: an unlimited card tailor-made for independent and arthouse cinemas. From the start, the goal was to boost visibility and engagement for less mainstream films and to make cinema-going a more spontaneous, casual, and social experience.

From then on, the model took off. Initially limited to 13 venues in Amsterdam, Cineville’s success reshaped local cinema habits across the Netherlands. The card removed the perception of financial barriers, allowing members to take more risks and see unfamiliar films. Fifteen years later, Cineville is an integral part of Dutch cinema culture. In 2024, its 107,000 subscribers accounted for 2.2 million admissions across 74 cinemas in 39 cities. For local arthouses, Cineville has become the norm.

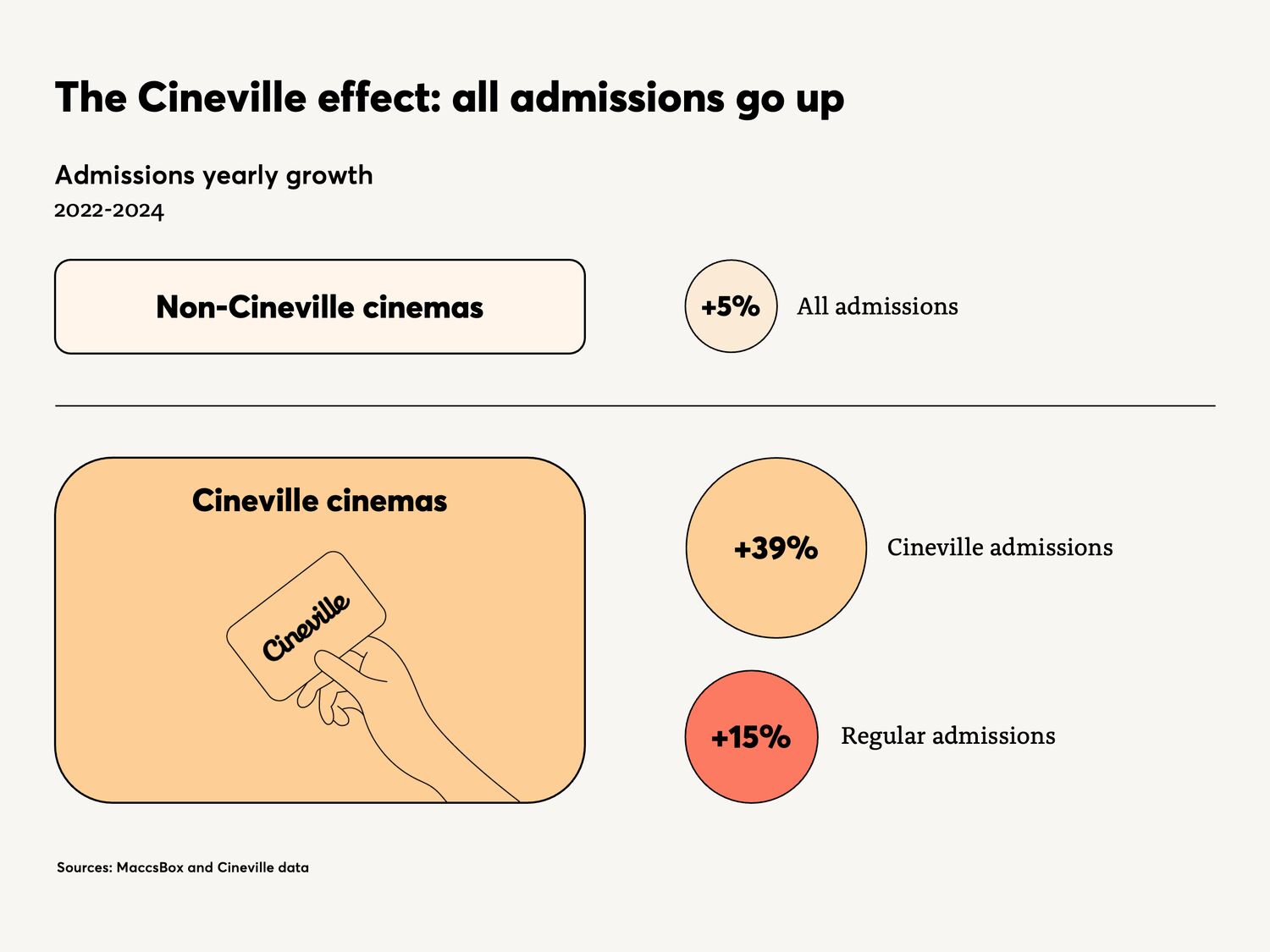

The model has had a measurable impact on participating cinemas. It has supported steady growth in admissions and accelerated post-pandemic recovery. While overall visits to Dutch cinemas increased by 5 percent between 2022 and 2024, Cineville cinemas saw a 15 percent increase in regular admissions and a 39 percent rise in admissions through the Cineville card. This model has proven effective in building long-term growth and stability for independent cinemas in the Netherlands.

Built on collaboration, owned by cinemas

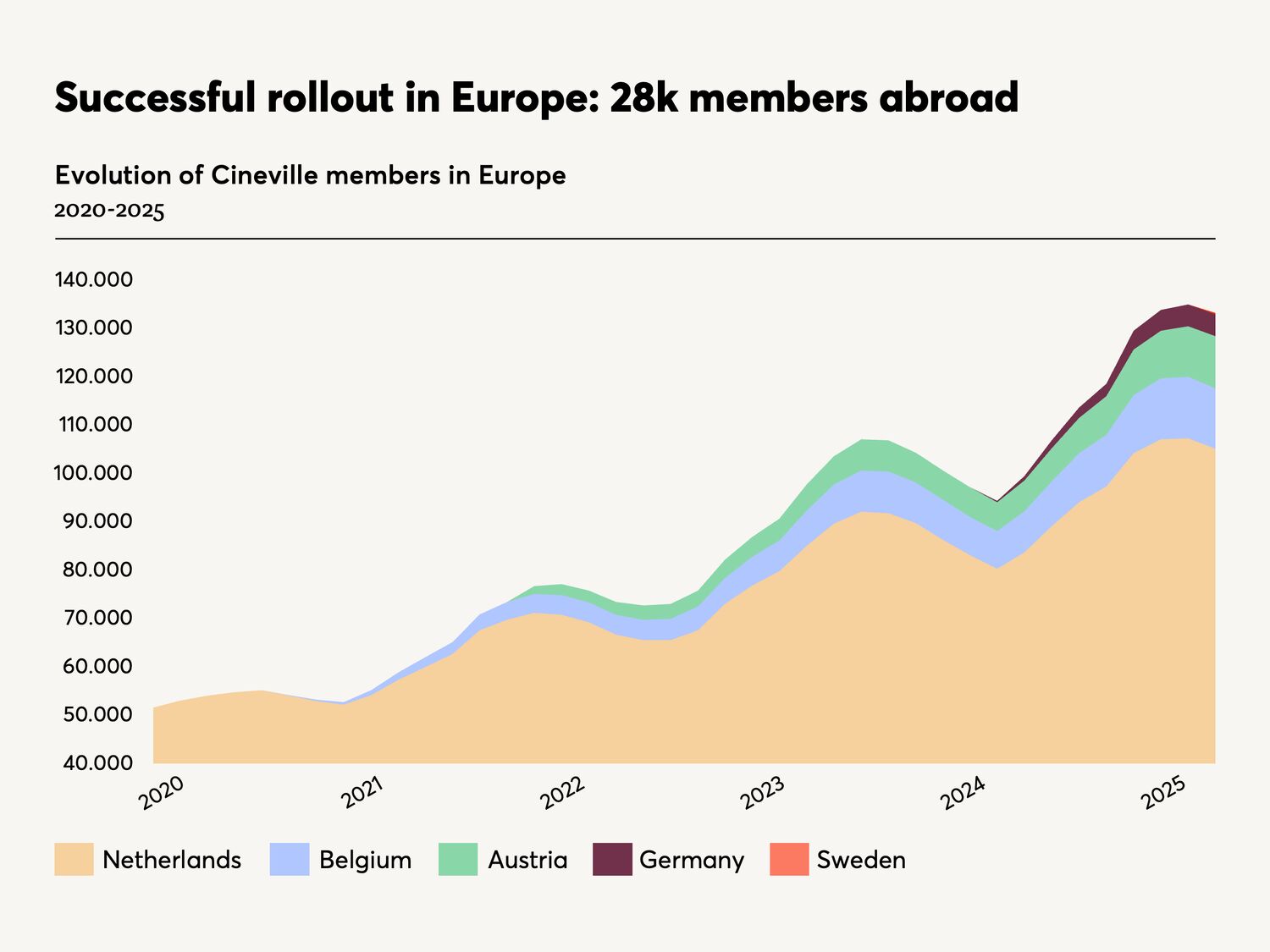

Thanks to support from Europa Cinemas and the Creative Europe MEDIA Programme’s Collaborate to Innovate grant, Cineville began expanding into new markets. The card launched in Belgium in 2022, Austria in 2023, Germany in 2024, and most recently Sweden in April 2025.

Early results have been strong. Belgium now counts 13,000 subscribers and nearly half a million Cineville admissions since launch. Austria has grown to over 10,000 cardholders across 29 cinemas. In Germany, subscriber numbers are approaching 5,000, while Swedish cinemas welcomed their first members from day one.

What’s worth highlighting is how, in each of these countries, the Cineville project has been led and owned by a motivated coalition of local cinemas. It is they who have shaped and launched the model in their country, making Cineville an integral part of their collective identity.

One of Cineville’s defining features is this collaborative structure. In a sector often marked by competition, even between independent venues, Cineville invites cinemas to co-own the model. This includes joint decision-making on pricing, branding, marketing, and strategic direction.

Cinemas are not just participants. They are partners. This model helps address concerns around competition, audience cannibalisation, or membership fees. Instead, operators benefit from pooled resources, shared visibility, and consistent revenue.

The model is also designed to support financial sustainability. Today, in the Netherlands, Cineville guarantees 85 percent of the average ticket price back to cinemas, meaning each visit typically brings €9.50 in revenue. This reliable income helps mitigate programming volatility and supports cinemas with limited marketing capacity.

Existing hurdles to adoption

The success of the Cineville model, of course, depends on how local cinema landscapes are structured. Some cinemas might, for instance, prefer to develop their own branded cards, retaining greater control over their audience relationships. But for most, this is difficult to sustain, especially considering the required digital infrastructure. Audience surveys have shown that Cineville does not dilute the identity of local cinemas, but rather reinforces the sense of community between cinemagoers and their favourite independent venues.

The bigger hurdles, however, are more closely tied to how organised a local market is: is there a national arthouse association? Are cinemas accustomed to working together? How entrenched is the sense of competition? Do venues believe in the long-term value of a subscription model? In more fragmented or competitive markets, adoption tends to be slower.

The model has consistently taken root first in urban areas, where multiple independent venues can collectively offer variety and value to subscribers. Be it in Belgium, Germany, Austria or Sweden, local Cineville initiatives have typically launched in major cities with several participating cinemas. However, the model also works well in non-urban areas. What’s essential is reaching enough initial volume to sustain the offer. In that sense, cities act more as drivers for early growth and scale rather than as the only viable context.

From a financial perspective, the main challenge is often simply a lack of resources to launch a shared scheme like Cineville. While securing local or European support can be difficult, initiatives such as Europa Cinemas’ Collaborate to Innovate have fortunately proven highly supportive.

According to Cineville, and based on results in Belgium and Austria, financial autonomy for the model is generally achieved at around 10,000 subscriptions, with both countries surpassing this milestone. Germany is currently following a similar trajectory.

Changing behaviours and growing younger audiences

Cineville has also proven effective at attracting younger audiences. Across all countries, a significant share of subscribers are under 35. In Belgium and Austria, they represent over 65 percent of subscribers.

This shift supports a more diverse and adventurous cinema culture. Cineville members tend to visit significantly more often, up to 25 times a year in the Netherlands, compared to a national average of just 1.8 annual visits. They are also more open to discovering new films, genres, and venues. While subscribers can use the card for mainstream titles, 86 percent regularly choose independent films outside their usual preferences.

Cineville also provides tailored promotional tools and editorial content through its app and website, helping cinemas engage audiences with curated film tips and original articles. Independent distributors also benefit from increased visibility for their releases through Cineville’s platform. In turn, this allows cinemas to take more risks with their programming, knowing there is an audience ready to respond.

The Cineville Netherlands team, for instance, attended the Cannes Film Festival not only to watch films but also to write reviews, create marketing content, and support promotional efforts for Dutch cinemas. Their presence enabled Cineville to connect audiences with fresh, relevant titles as they premiere on the international stage and prepare for local distribution.

Cineville’s appeal goes beyond content. It turns cinema into a lifestyle, creating a sense of community and belonging. Some cardholders even mention Cineville on dating apps, an example of how cultural habits can become part of one’s identity. This emotional connection plays a key role in strengthening loyalty and repeat visits.

Looking ahead

Cineville’s model is not only scalable. It is replicable. As it continues to grow with support from the EU, the company is also investing in the development of digital tools. Among them is a real-time data dashboard that will give cinemas and distributors new insights into audience behaviour, from trailer views to confirmed bookings.

This evolution speaks to Cineville’s broader mission: to make cinema-going a natural and frequent part of people’s lives and to build a sustainable future for independent cinemas through collaboration, technology, and community.

Cineville is currently in conversation with several stakeholders in Europe to explore local launch opportunities. Stay tuned for upcoming announcements.

At this year’s Cannes Film Festival, Europa Cinemas turned the spotlight on the growing relevance of subscription models for European arthouse cinemas, after already exploring the topic at their latest annual conference and innovation lab, and conducting broader research into the opportunities and challenges these models present. There is even a belief that we could soon see the launch of a cross-border subscription model. This is an exciting ambition that builds on the growing momentum across the continent. While such a model would come with its own set of complexities, from technical and legal requirements to pricing structures that respect local contexts, it also represents an exciting unifying goal for the future of arthouse and independent cinemas in Europe.

Subscription models, when built on collaboration and tailored to local contexts, can help revitalise independent cinema. Whether city-led initiatives, national schemes, or smaller coalitions of venues, different structures can work effectively, aligning with their own audiences and resources. However, broader (inter)national schemes often have an added advantage: they can foster a stronger sense of belonging by connecting audiences to a wider, shared cinema culture.

What matters is the underlying shift: reinforcing the feeling of being part of a community and making cinema-going a more casual experience. As independent venues across Europe explore new strategies to remain vital, unlimited schemes can offer a powerful framework for audience engagement and long-term sustainability.

As subscription models gain momentum across Europe, they are demonstrating that collaboration over competition can pave the way for a stronger, more resilient future for arthouse cinemas.

16.06.2025

Guillaume Branders

Guillaume Branders is the founder of studio funambule, a consultancy that helps film and cinema professionals connect, grow, and innovate. Based in Belgium, he has been immersed in the cinema industry for almost 15 years. Starting at Cinema Aventure, an arthouse venue in the center of Brussels, he later worked as the Head of Industry Relations at UNIC, the trade association of European cinemas and their national associations. After two years working for a cinema software company, he decided to launch his own venture and explore new ways to drive innovation in the cinema industry. more from the author